Journal Article

Transitions in the stock markets of the US, UK and Germany

Quantitative Finance

Authors

Publication Date

JEL Classification

G11

G12

Key Words

Related Topics

Financial Markets

USA

Germany

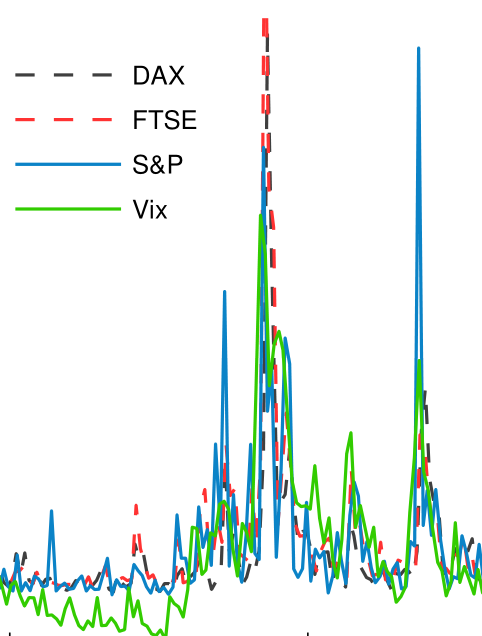

In an analysis of the US, the UK and German stock market, we find a change in the behaviour based on the stocks’ beta values. In the years 1995–2006, trades of stocks with high beta and large volume were concentrated in the IT and technology sector, whereas in 2006–2012 those trades are dominated by stocks from the financial sector. We show that an agent-based model can reproduce such a transition. We further show that the initial impulse for the transition might stem from the increase of high-frequency trading at that time.