Working Paper

Labor Turnover Costs, Workers' Heterogeneity and Optimal Monetary Policy

Authors

Publication Date

JEL Classification

Key Words

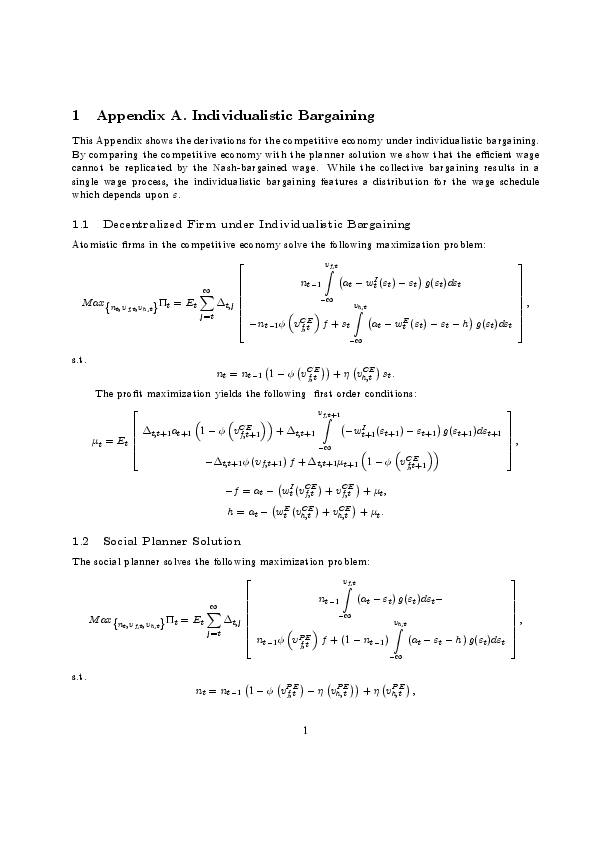

We study the design of optimal monetary policy in a New Keynesian model with labor turnover costs in which wages are set according to a right to manage bargaining where the firms’ counterpart is given by currently employed workers. Our model captures well the salient features of European labor market, as it leads to sclerotic dynamics of worker flows. The coexistence of those types of labor market frictions alongside with sticky prices gives rise to a non-trivial trade-off for the monetary authority. In this framework, firms and current employees extract rents and the policy maker finds it optimal to use state contingent inflation taxes/subsidies to smooth those rents. Hence, in the optimal Ramsey plan, inflation deviates from zero and the optimal volatility of inflation is an increasing function of firing costs. The optimal rule should react to employment alongside inflation.