Journal Article

Labor Selection, Turnover Costs and Optimal Monetary Policy

Journal of Money, Credit and Banking

Authors

Publication Date

JEL Classification

E52

E24

Key Words

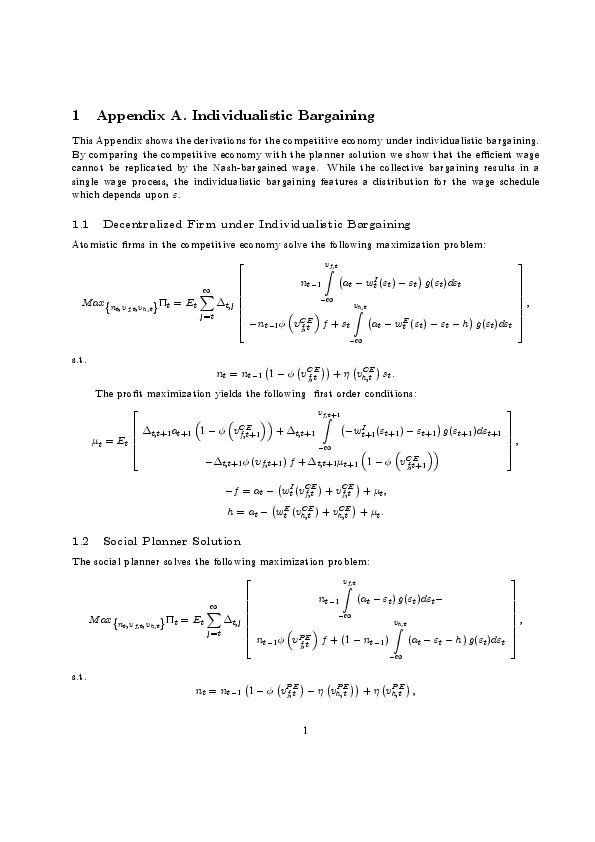

We study optimal monetary policy and welfare properties of a DSGE model with a labor selection process, labor turnover costs and Nash bargained wages. We show that our model implies ineffciencies which cannot be offset in a standard wage bargaining regime. We also show that the inefficiencies rise with the magnitude of firing costs. As a result, in the optimal Ramsey plan, the optimal inflation volatility deviates from zero and is an increasing function of firing costs.